In a post-coronavirus investment world, Jeff argues that investors should be rethinking the role of fixed income in portfolio construction and ask themselves if they are at risk of investing without a parachute?

In the wake of the coronavirus crisis, the U.S. bond market finds itself flirting with negative interest rates and bumping up against the “zero lower bound” — calling into question the ability of bonds to provide ballast in future equity sell-offs.

Rethinking fixed income at the “zero lower bound”

Historically, investors have allocated to fixed income to meet any of three key objectives: capital appreciation, income generation, and preservation of principal. Fixed income’s typical ability to provide ballast against equity sell-offs rests in the normal response of lower interest rates to falling stocks —resulting in a general negative correlation between bonds and stocks. When stock prices fall, bonds prices tend to rise. However, in recent years, super low, zero and even negative interest rates have driven up the value of fixed income securities limiting further capital appreciation and calling into question the asset class’s ability to diversify against future equity drawdowns.

At the same time, the coronavirus crisis is pushing the Fed to lower interest rates to zero for the second time in just over a decade. Now, policy makers are bumping up against the “zero lower bound” on interest rates — or theoretical lowest level that interest rates can fall to before they become unenticing to investors and ineffective as a way to stimulate economic growth. While it is true that negative rates have been seen in other countries around the world before, the scope of negative rates is limited. Why? Interest rates cannot fall (much) below zero because if they do, investors have the option of holding cash which pays no interest, but that is better than a negative-yielding asset.

In this historically unprecedented period, investors should be rethinking the role of fixed income in portfolio construction and ask themselves: Am I investing without a parachute? The answer requires a reexamination of the Global Financial Crisis and the last bout of zero interest rate policy.

From the fear of rising to the fear rates can’t go low enough

After the Global Financial Crisis, the fear was future increases in interest rates. Today, it is the fear interest rates won’t be able fall far enough to provide the safety investors expect from bonds.

The below graph puts the discussion in its historical context. The average decline in the Fed’s policy rate during recessions averages nearly 400 bps – yet the cuts to zero in response to the coronavirus crisis amount to only 175 bps. For longer maturities, the 10-year interest rate on average falls over 300 bps during recessions. Coming into the coronavirus crisis, the 10-year Treasury stood at around 1.75% and has fallen around 100bps. And unlike during the Global Financial Crisis, further declines in longer term interest rates are clearly more limited. Today the 30-year Treasury yield stands just under 1.4% in contrast to close to 5% in the leadup to the Global Financial Crisis.

This implies simply less room for rates to fall when the Fed needs to again provide future accommodation. With zero as the effective lower bound, potential rate declines from here stand clearly lower than in past recessionary periods, implying less potential for positive fixed income returns to offset negative equity returns. So, bond ballast likely remains, but the ZLB limits its amount. In such an environment, alternative forms of ballast take on even greater importance.

Exploring alternative forms of portfolio diversification

In the following section we review an alternative approach to adding ballast to a portfolio we call “Defensive Alpha”—which attempts to take advantage of “dispersion” across a broad universe of equities. There are three key structural components to what can make Defensive Alpha an effective portfolio diversifier which we will now walk-through (see figure below).

1. Equity dispersion has tended to rise when markets fall

First, Defensive Alpha seeks to generate returns based on individual stock performance through long and short positions. The potential return, or “alpha” available from this type of investment strategy is the degree to which the market differentiates these individual, or “idiosyncratic” characteristics of stock returns relative to each other. We call this “dispersion.” Higher dispersion is synonymous with events catalyzing greater winners and losers. This is the opposite of the idea that rising tides lift all boats. Falling markets may create greater differentiation between winners and losers and potentially greater return opportunities.

2. Companies with leverage have tended to show increase dispersion

Second, leverage on the balance sheet has increased dispersion. So, a universe of companies using debt may exhibit more dispersion than companies without debt. Limiting the stock selection universe to companies with debt increases the dispersion and hence the potential alpha of our approach.

3. Equity valuations has been more dependent on debt-based metrics during drawdowns

Finally, in good markets the income statement perspective has dominated equity valuation (e.g. revenue growth, net income, EPS). In bad markets, debt-based metrics that are found on the balance sheet rules. This regime dependence of information provides an important third source of structural diversification. The more stressed the environment, the more important debt-based measures of resilience (e.g. indebtedness, liquidity, cash flow and funding costs) become. This increasing relative importance of credit information occurs most strongly when stock markets have fallen in anticipation of recessions and that has tended to increase the defensive nature of the potential alpha returns.

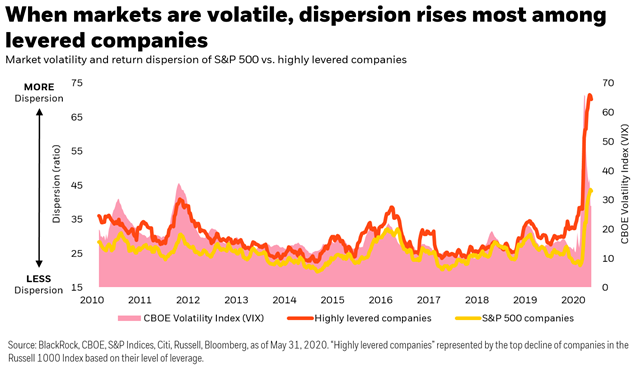

The below figure highlights these important structural characteristics. As you can see, as the volatility of the market rises (pink area), a universe of the most highly levered companies (orange line) display greater levels of dispersion than the typical universe of companies in the S&P 500 (yellow line).

Ultimately, this higher level of dispersion can potentially lead to more opportunities to generate positive returns even when equity markets fall.

Putting it all together

Putting all three of these structural characteristics together can create an alternative form of diversification that may complement the traditional ballast provided by bonds.

Note that while these structural characteristics may be expected to be persistent, not every down stock market is associated with these trends. We have seen occasions when dispersion falls during rapid equity market declines and even quality balance sheet companies under-perform during sell-offs. Hence, these structural characteristics support an expectation, though not a guarantee, of diversification.

The bottom line

In the post-coronavirus investment world, proximity to the ZLB challenges the long-term ability of fixed income to provide diversification for equity portfolios.

Alternative investment approaches such as those targeting Defensive Alpha can provide investors with additional forms of portfolio diversification when bond allocations may not be sufficient.

Jeffrey Rosenberg, CFA, is a senior portfolio manager for BlackRock’s Systematic Fixed Income (“SFI”) team and a regular contributor to The Blog.

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of June 2020 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.